Understanding Watch Import Tariffs: How They Affect Your Purchase

60-Second Summary

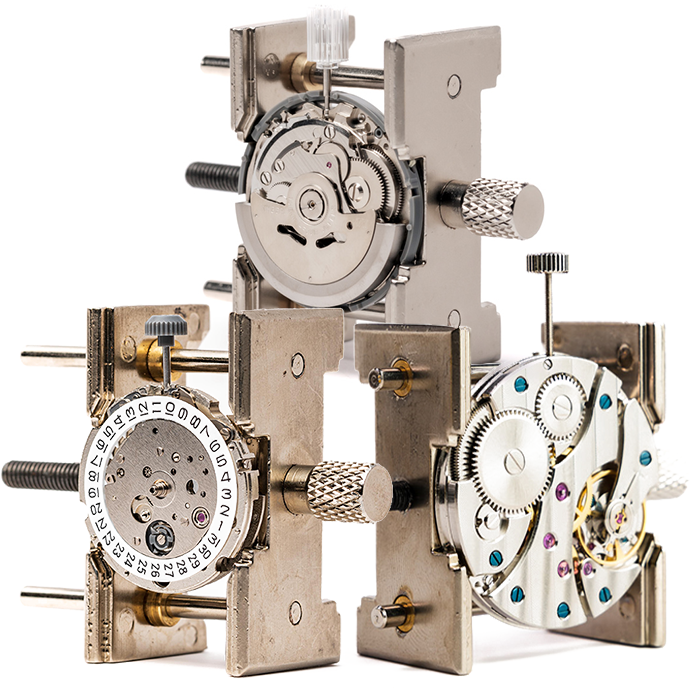

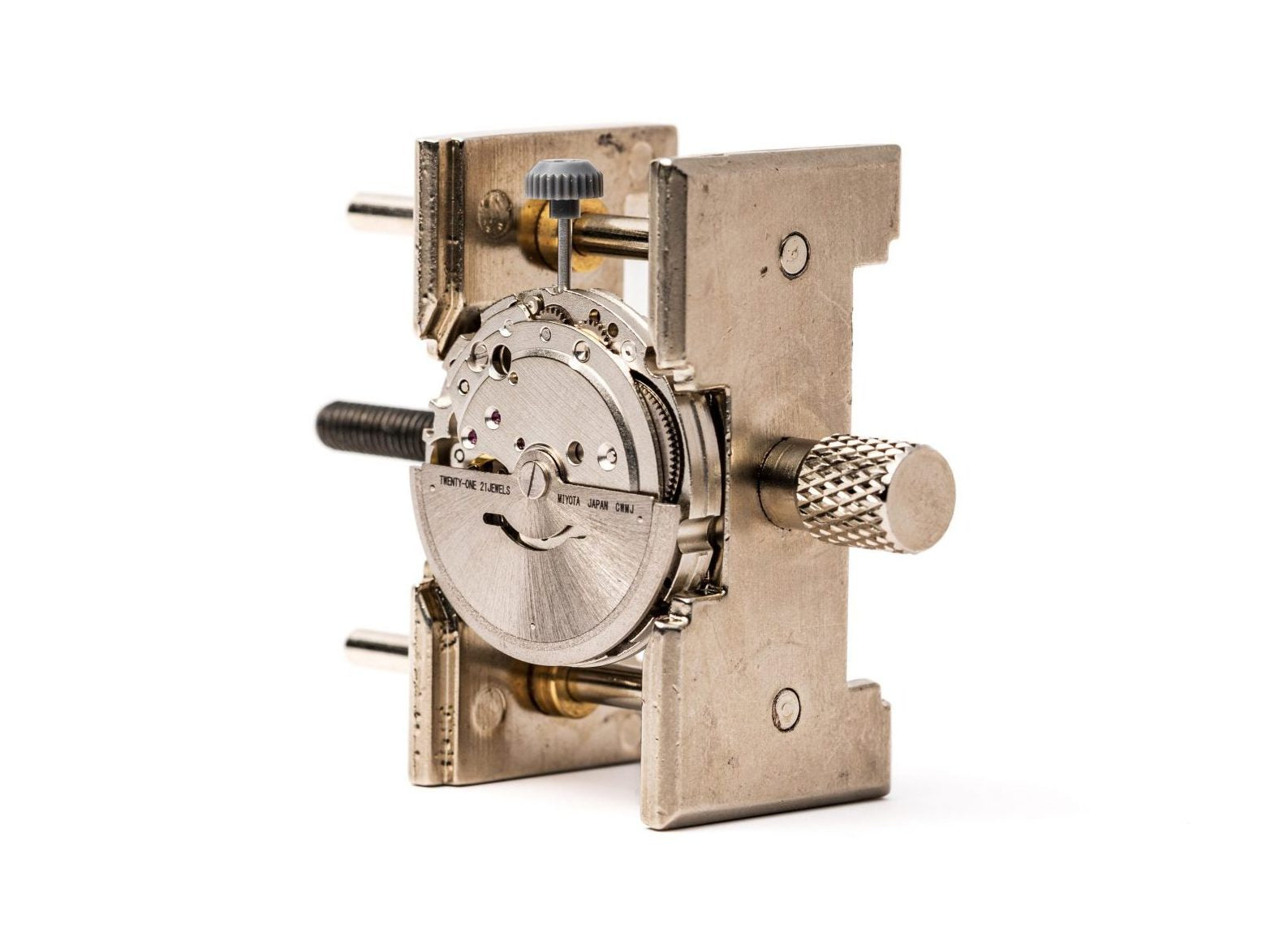

Watch import tariffs significantly impact the final price you pay for timepieces and watch kits. Understanding watch tariffs in 2026 helps you make informed purchasing decisions, whether you're buying from international suppliers or domestic companies like Rotate Watches. Import fees for watches vary based on country of origin, materials, and value, while US watch tariff exemptions apply to certain categories. Watch customs duties can add 15-30% to your total cost, making domestically assembled kits more attractive. Smart buyers choose American-assembled options to avoid these additional costs while still getting premium components from trusted manufacturers like Seiko, Miyota, and Seagull.

What Are Watch Import Tariffs and Why Do You Need to Know About Them

Watch import tariffs are taxes imposed by governments on timepieces crossing international borders. When you purchase a watch or watch kit from overseas, customs authorities assess these fees based on the item's declared value, country of origin, and materials used.

Most consumers don't realize how significantly these tariffs impact our final purchase price. A watch kit that costs $200 overseas might end up costing $250-280 after import fees for watches are added. The exact percentage depends on trade agreements between countries and current tariff schedules.

Understanding these costs helps you budget accurately and compare true prices between domestic and international suppliers. Learn more about how to start watch collecting while considering these financial factors.

How Watch Tariffs in 2026 Affect Your DIY Watch Building Budget

Watch tariffs in 2026 remain complex, with rates varying significantly based on watch type and origin. Complete watches typically face higher tariff rates than individual components, making DIY assembly an attractive option for budget-conscious builders.

When importing watch kits, you'll encounter duties ranging from 9.8% to 23% depending on the case material and movement type. Stainless steel cases face different rates than precious metal cases, while mechanical movements are classified differently than quartz movements.

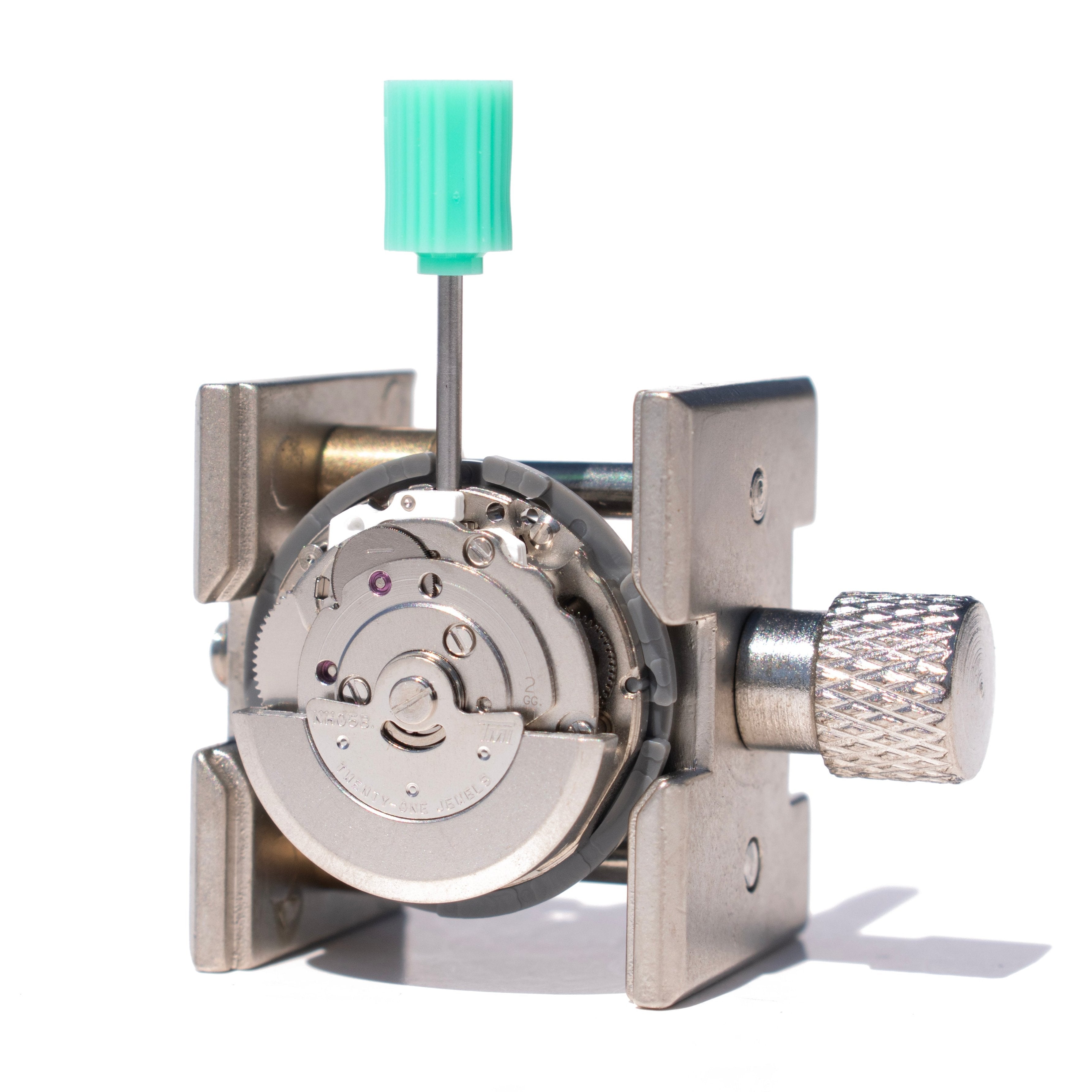

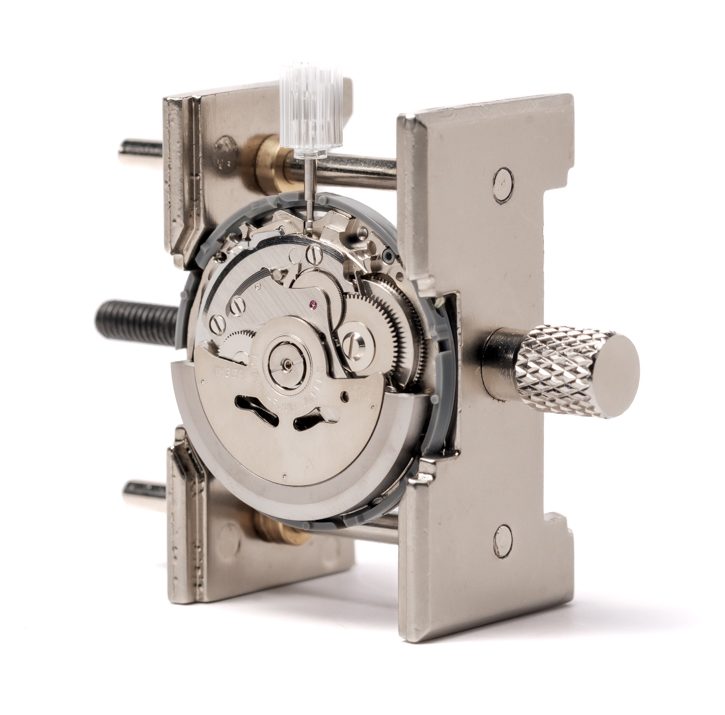

These tariffs make domestically assembled kits increasingly competitive. Companies like Rotate Watches source premium movements from established manufacturers but assemble complete kits in Los Angeles, helping customers avoid import fees for watches entirely.

For watch enthusiasts building multiple timepieces, these savings add up quickly. A collector purchasing three kits annually could save hundreds of dollars by choosing domestic assembly options. Learn more about mechanical watch basics to understand why quality movements matter regardless of assembly location.

Understanding Import Fees for Watches and Hidden Costs

Import fees for watches extend beyond basic tariffs to include processing fees, customs broker charges, and potential storage costs. These additional expenses can add $30-50 to your order, regardless of the watch's value.

Customs processing fees apply to most international shipments, typically ranging from $25-35 per package. If your shipment requires inspection or additional documentation, expect delays and extra charges. Some carriers add fuel surcharges and international handling fees that aren't immediately apparent at checkout.

Storage fees become relevant if customs hold your package for inspection or if you're unavailable to receive delivery. These daily charges accumulate quickly and can significantly impact your total cost.

Choosing domestic suppliers eliminates these uncertainties entirely. Rotate Watches ships from US warehouses, ensuring predictable delivery times and transparent pricing. Explore our watchmaking kits to experience hassle-free ordering.

Watch Customs Duties Explained for Different Materials and Components

Watch customs duties vary dramatically based on materials and complexity. Stainless steel cases face different rates than titanium or precious metal cases, while leather straps are classified separately from metal bracelets.

Mechanical movements typically face higher duties than quartz movements, reflecting our perceived luxury status. However, individual components like dials, hands, and crystals often qualify for lower rates, making DIY assembly economically advantageous.

Case materials significantly impact duty calculations. Stainless steel watches face approximately 9.8% duties, while gold-plated cases can trigger rates exceeding 20%. Ceramic and titanium cases fall into specialized categories with our own rate structures.

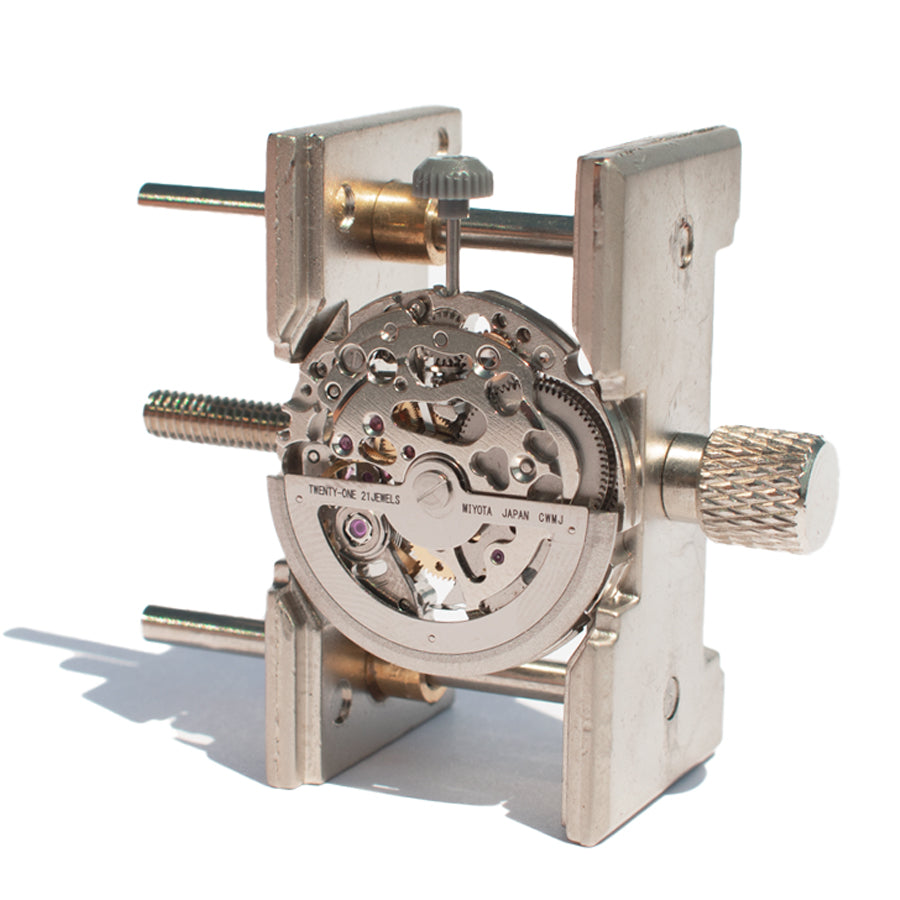

Understanding these distinctions helps you make informed purchasing decisions. Premium movements from manufacturers like Seiko and Miyota maintain our quality regardless of final assembly location. Learn more about top Swiss movements and Japanese movements to understand why component quality matters more than country of assembly.

US Watch Tariff Exemptions and Special Categories

US watch tariff exemptions apply to specific categories and trade agreements, though these rules change frequently. Certain educational kits and repair components may qualify for reduced rates or exemptions under specific circumstances.

Trade agreements with particular countries can affect tariff rates, though these deals often contain complex requirements regarding local content and assembly. Understanding these nuances requires staying current with trade regulations that change regularly.

Some components qualify for preferential treatment under manufacturing exemptions. However, these rules are complex and often require extensive documentation to verify compliance. Most consumers find the paperwork requirements impractical for personal purchases.

The simplest approach involves choosing suppliers who handle these complexities for you. Rotate Watches assembles complete kits domestically using premium international components, providing the best of both worlds without customs complications.

Domestic vs International Watch Kit Purchasing Strategy

Smart watch enthusiasts develop purchasing strategies that minimize watch import tariffs while maximizing component quality. The key lies in understanding where value creation occurs in the supply chain.

Premium movements from established manufacturers like Seiko, Miyota, and Seagull maintain consistent quality regardless of final assembly location. The critical factor is working with companies that properly handle, test, and package these components.

Domestic assembly offers several advantages beyond tariff avoidance. Faster shipping times, easier returns, and local customer support create value that often exceeds simple cost savings. When problems arise, dealing with domestic companies eliminates international shipping and customs delays.

Consider your total cost of ownership when evaluating options. A slightly higher upfront price for domestic assembly often provides better value when you factor in shipping speed, return convenience, and customer support quality.

Rotate Watches exemplifies this approach, offering complete watchmaking kits with premium movements and comprehensive support. Their watch movement kits provide educational value while avoiding import complications.

How to Calculate Total Watch Import Tariffs Before Purchase

Calculating watch import tariffs requires understanding multiple fee components and our application methods. Start with the watch's declared value, then apply the appropriate tariff percentage based on materials and country of origin.

Add customs processing fees, which typically range from $25-35 regardless of package value. Include carrier-specific international handling charges and any fuel surcharges that apply to your shipment method.

Consider potential storage fees if customs inspection or delivery delays occur. These daily charges can accumulate quickly, particularly during busy shipping seasons or when packages require additional documentation.

Many online calculators provide estimates, but actual costs often exceed these projections due to hidden fees and processing charges. The safest approach involves requesting detailed cost breakdowns from suppliers before ordering.

Working with domestic suppliers eliminates these calculations entirely. Rotate Watches provides transparent pricing with no hidden international fees, making budget planning straightforward. Check out our automatic watch winder and other accessories for complete timing solutions.

Start your watchmaking journey with Rotate Watches, where complete DIY watch kits transform curiosity into craftsmanship.

Browse our watchmaking kits collection to find your perfect match, from complete watch kits to intricate movement kits.

Your watchmaking story begins with a single screw. Start building today.

FAQ

Q. How do watch import tariffs affect the final price I pay?

Watch import tariffs typically add 15-30% to your total cost, including the base tariff rate plus processing fees, customs broker charges, and potential storage costs.

Q. What are typical import fees for watches from Asian suppliers?

Import fees for watches from Asian suppliers range from 9.8% to 23% depending on materials, plus $25-50 in processing and handling charges per shipment.

Q. Are there US watch tariff exemptions for educational or DIY kits?

US watch tariff exemptions for educational kits are limited and require extensive documentation. Most consumers find domestic assembly more practical than navigating exemption requirements.

Q. How do watch customs duties differ between materials like steel vs gold?

Watch customs duties vary significantly by material - stainless steel faces approximately 9.8% while gold-plated cases can trigger rates exceeding 20% depending on gold content.

Q. Can I avoid watch tariffs in 2026 by choosing domestic suppliers?

Yes, choosing domestic suppliers like Rotate Watches eliminates watch tariffs in 2026 entirely while still providing access to premium international components assembled locally.

Q. What hidden costs should I expect beyond basic watch import tariffs?

Beyond basic watch import tariffs, expect customs processing fees ($25-35), carrier handling charges, fuel surcharges, and potential storage fees if delays occur during customs processing.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "How do watch import tariffs affect the final price I pay?", "acceptedAnswer": { "@type": "Answer", "text": "Watch import tariffs typically add 15-30% to your total cost, including the base tariff rate plus processing fees, customs broker charges, and potential storage costs." } }, { "@type": "Question", "name": "What are typical import fees for watches from Asian suppliers?", "acceptedAnswer": { "@type": "Answer", "text": "Import fees for watches from Asian suppliers range from 9.8% to 23% depending on materials, plus $25-50 in processing and handling charges per shipment." } }, { "@type": "Question", "name": "Are there US watch tariff exemptions for educational or DIY kits?", "acceptedAnswer": { "@type": "Answer", "text": "US watch tariff exemptions for educational kits are limited and require extensive documentation. Most consumers find domestic assembly more practical than navigating exemption requirements." } }, { "@type": "Question", "name": "How do watch customs duties differ between materials like steel vs gold?", "acceptedAnswer": { "@type": "Answer", "text": "Watch customs duties vary significantly by material - stainless steel faces approximately 9.8% while gold-plated cases can trigger rates exceeding 20% depending on gold content." } }, { "@type": "Question", "name": "Can I avoid watch tariffs in 2026 by choosing domestic suppliers?", "acceptedAnswer": { "@type": "Answer", "text": "Yes, choosing domestic suppliers like Rotate Watches eliminates watch tariffs in 2026 entirely while still providing access to premium international components assembled locally." } }, { "@type": "Question", "name": "What hidden costs should I expect beyond basic watch import tariffs?", "acceptedAnswer": { "@type": "Answer", "text": "Beyond basic watch import tariffs, expect customs processing fees ($25-35), carrier handling charges, fuel surcharges, and potential storage fees if delays occur during customs processing." } } ] }